Australia’s general insurance industry has achieved a remarkable financial milestone, reporting a combined after-tax profit of $7.3 billion for the 12 months ending June 30, 2025. This surge comes at a time when consumers are grappling with escalating premiums, drawing increased attention from regulators and the public.

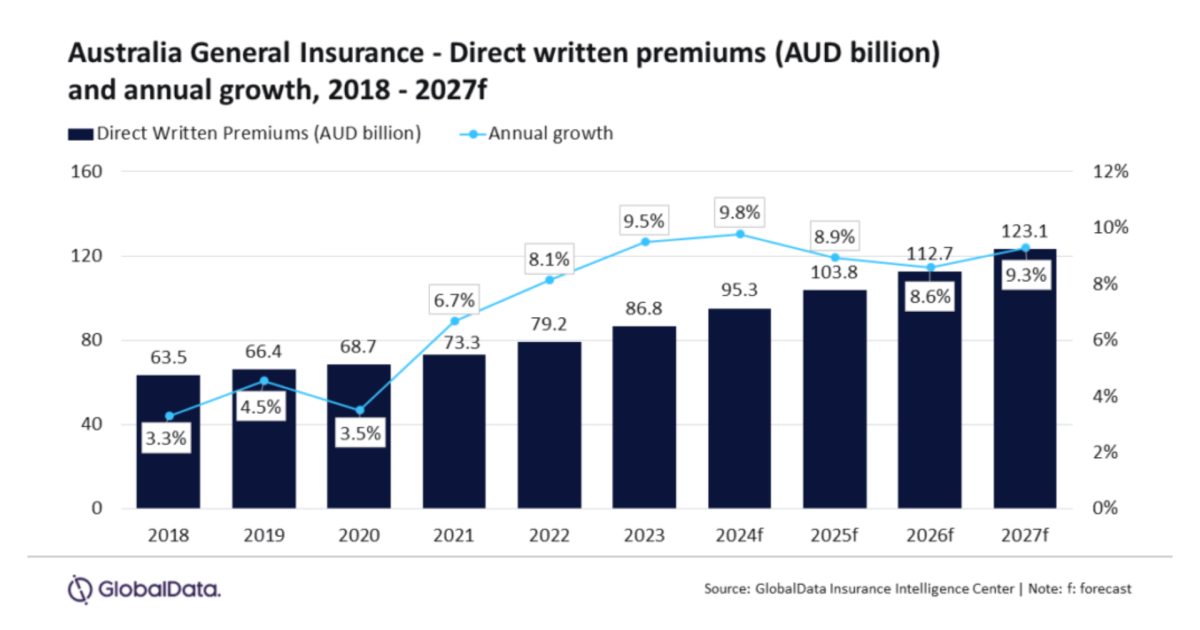

Australia’s general insurance sector to surge 9.1% by 2027 | Insurance Asia

Key Highlights

- Record-Breaking Profits: The industry posted $7.3 billion in after-tax profits, a sharp rise from $3.9 billion in the previous nine-month period ending June 2024.

- Direct Insurers’ Contribution: They accounted for $6.7 billion of the total, with a 19% return on capital, up from an annualized 14% the year before.

- Reinsurers’ Performance: Reinsurers added $600 million in profits, achieving a 12% return on capital.

- Solvency Strength: Direct insurers’ solvency coverage improved to 189% from 177%, while reinsurers held steady at 188%.

Australian Insurance Market Statistics: General & Life Insurance

Profit Breakdown by Segment

The following table outlines the insurance service results (profits) for key segments, both reaching decade-high performances:

| Segment | Insurance Service Result |

|---|---|

| Domestic Motor Insurance | $1.26 billion |

| Householders’ Insurance | $1.16 billion |

Reasons for the Profit Surge

The impressive results stem from a combination of favorable conditions and strategic factors:

- Low catastrophe losses due to milder weather events.

- Robust investment returns boosting overall earnings.

- Ongoing premium hikes in household, motor, and commercial property insurance over recent years.

- Reserve releases in both short- and long-tail claims, lowering effective claim costs.

22-year record hike nobody’s talking about as insurance premiums from Suncorp, IAG and QBE skyrocket | news.com.au — Australia’s leading news site for latest headlines

Areas of Rising Scrutiny

While profits soar, the industry faces growing criticism over premium affordability and practices:

- Sharply increasing premiums prompting concerns about pricing fairness and transparency.

- Consumers opting for higher excesses or reduced coverage to cope with costs.

- Challenges in providing affordable insurance in high-risk areas prone to natural disasters.

- Calls for insurers to prioritize customer trust and sustainable outcomes over short-term gains.

Big private health insurers make huge profits… but they want you to pay more – The Australia Institute

Emerging Risks and Future Outlook

Looking ahead, the sector must navigate potential threats to maintain stability:

- Climate change leading to more frequent and severe weather events.

- Energy transition issues, such as risks from battery fires and new property damages.

- Rapid AI adoption in claims and underwriting, raising governance and fairness concerns.

In summary, this record profit highlights the resilience of Australia’s general insurers but underscores the need for balanced approaches amid consumer and regulatory pressures. Staying informed on insurance trends can help consumers make better decisions.