Car title loans can be a viable option for immigrants seeking quick cash without a Social Security Number (SSN). These loans use your vehicle’s title as collateral, allowing access to funds even if you lack traditional documentation. While many lenders require an Individual Taxpayer Identification Number (ITIN) as an alternative, some accept other forms of ID for approval. This guide explains the process in simple terms, helping you understand eligibility, requirements, and alternatives for car title loans without SSN.

What Are Car Title Loans?

Car title loans, also known as auto title loans or title pawns, are short-term loans where you borrow money against the value of your car. You keep driving the vehicle while repaying the loan, but the lender holds the title until it’s paid off. These loans are popular for their speed and minimal credit checks, making them accessible for immigrants without SSN.

Key features include:

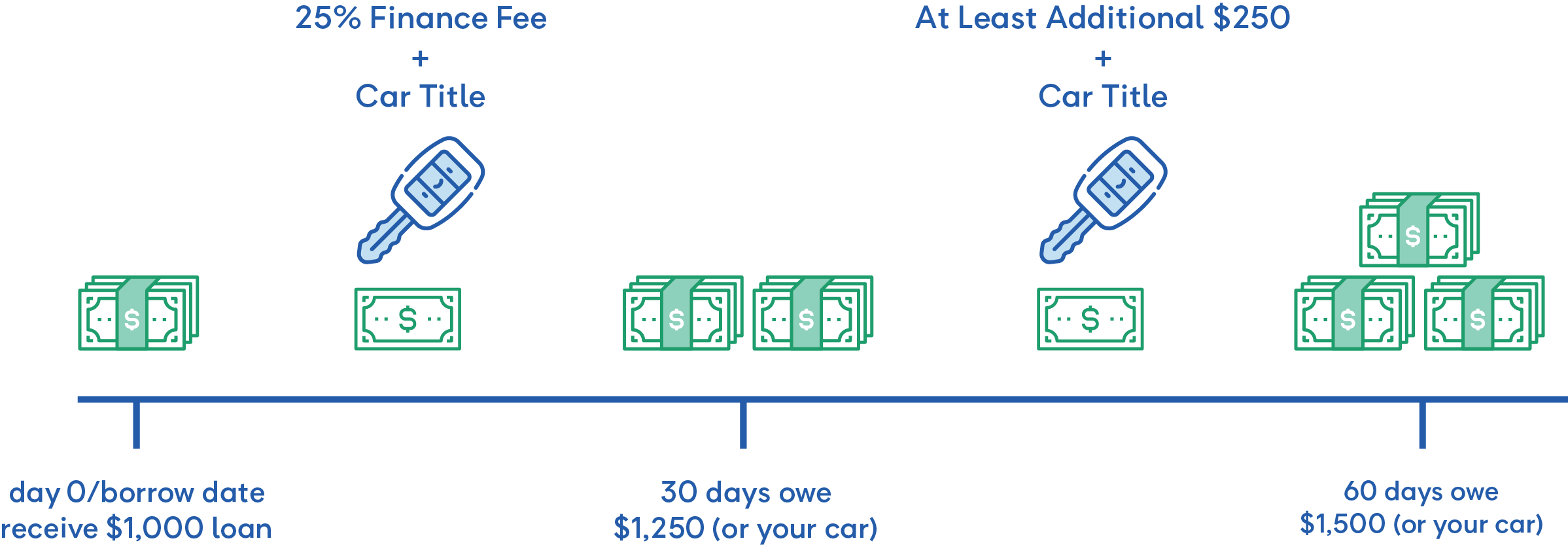

- Loan amounts typically range from $100 to $10,000, based on your car’s value.

- Repayment terms are usually 30 days to a few months, with high interest rates (often 25% per month or more).

- No strict credit history required, focusing instead on the vehicle’s equity.

What Is a Title Loan and How Does It Work? – OneMain Financial

Eligibility for Immigrants Without SSN

Yes, immigrants can get car title loans without an SSN in many cases. It’s legal in the U.S. with proper documentation. Lenders like TitleMax, LoanMart, and Max Cash often accept applications from non-citizens, including undocumented immigrants, by using an ITIN or other IDs.

However:

- Most lenders prefer or require an ITIN, which is issued by the IRS for tax purposes regardless of immigration status.

- If you don’t have an ITIN, some allow in-person applications with a passport, driver’s license, or matricula consular.

- You must be at least 18 years old and own a vehicle with a clear title (no outstanding loans on it).

Note: Availability varies by state, as title loans are regulated differently. Check local laws for restrictions.

Requirements for Car Title Loans Without SSN

To apply, gather these common documents. Requirements may differ by lender, but here’s a typical list:

- Vehicle Title: Must be in your name and lien-free.

- Valid ID: Passport, state ID, driver’s license, or ITIN card.

- Proof of Income: Pay stubs, bank statements, or alternative sources like unemployment benefits or alimony (no traditional job required).

- Proof of Residence: Utility bill or lease agreement.

- Vehicle Inspection: Bring your car for appraisal.

- References: Some lenders ask for personal references.

No bank account? Many lenders offer cash or money transfer options.

How to Apply: Step-by-Step Guide

Applying for car title loans for immigrants without SSN is straightforward. Follow these steps:

- Research Lenders: Look for companies like TitleMax or Max Cash that cater to non-SSN applicants. Compare rates and terms online.

- Gather Documents: Prepare your ID, title, and proof of income.

- Apply Online or In-Store: Online for convenience, but in-store may be required without SSN/ITIN.

- Get Vehicle Appraised: The lender assesses your car’s value to determine loan amount.

- Sign Agreement: Review terms, including APR and repayment schedule.

- Receive Funds: Get cash the same day or next business day.

- Repay the Loan: Make payments on time to avoid repossession.

Pros and Cons of Car Title Loans Without SSN

| Aspect | Pros | Cons |

|---|---|---|

| Accessibility | Easy approval without SSN or credit check. | High risk of losing your car if unpaid. |

| Speed | Funds available quickly, often same day. | Extremely high interest rates (up to 300% APR). |

| Flexibility | No job or bank account needed in some cases. | Short repayment terms lead to debt cycles. |

| Amount | Based on car value, up to thousands. | Fees and charges can inflate costs. |

Alternatives to Car Title Loans for Immigrants

If title loans seem too risky, consider these options:

- ITIN Personal Loans: Lenders like Stilt offer loans up to $25,000 for immigrants using ITIN.

- Payday Loans: Short-term cash advances, but high fees; available without SSN in some states.

- Credit Union Loans: Some accept ITIN and offer lower rates for members.

- Community Programs: Non-profits provide low-interest loans for immigrants.

- Build Credit with ITIN: Apply for an ITIN to access more traditional financing.

Conclusion

Car title loans for immigrants without SSN provide fast financial relief, but they come with high costs and risks. Always borrow responsibly and explore alternatives first. If eligible, obtaining an ITIN can open more doors. Consult a financial advisor or check with lenders for personalized advice. For more on title loans without SSN, visit reputable sites or local stores.