If you’re facing a financial crunch and own a car outright, a car title loan might seem like a quick solution. These loans use your vehicle’s title as collateral, allowing you to borrow money without a traditional credit check. While standard car title loans often come with short repayment periods of 15 to 30 days, options with extended repayment terms—ranging from several months to even a few years in some states—can provide more flexibility. However, they also carry high risks, including steep interest rates and the potential loss of your vehicle. This guide breaks down what you need to know, what to watch out for, and how to choose wisely to make an informed decision.

What Is a Title Loan and How Does It Work? – OneMain Financial

What Are Car Title Loans with Extended Repayment Terms?

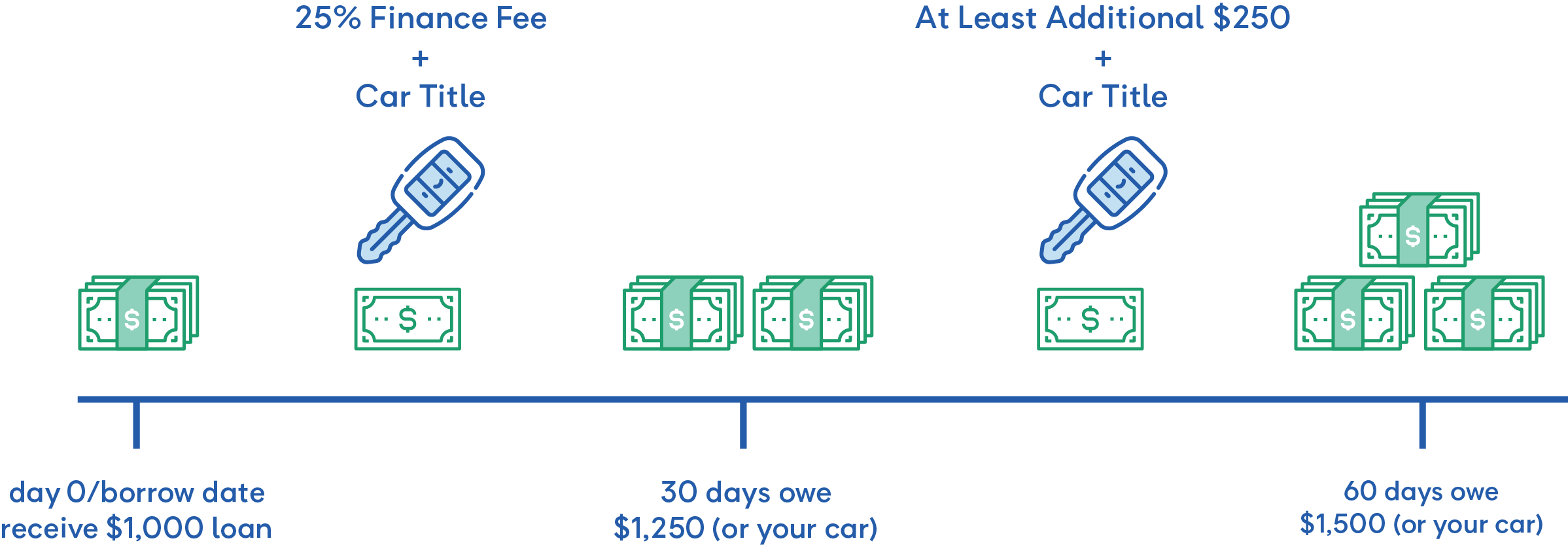

Car title loans, also known as auto title loans, are short-term secured loans where you pledge your car’s title to the lender in exchange for cash. Typically, these loans last 15 to 30 days and come with high annual percentage rates (APRs) that can exceed 300%. With extended repayment terms, some lenders offer installment plans that stretch payments over months or years, making monthly payments more manageable but potentially increasing the total cost due to accumulated interest.

In certain states like Arizona, regulations allow terms up to four years, though loan amounts are capped (e.g., no more than $5,000). Always check your state’s laws, as not all areas permit these loans or extended options.

Key Features:

- Loan Amount: Based on your car’s value, often 25% to 50% of its appraised worth.

- Repayment Period: Extended terms can be 6 months to 48 months, depending on the lender and state.

- Interest and Fees: High APRs, plus origination fees, late fees, and potential rollover costs.

- Collateral Risk: If you default, the lender can repossess and sell your car.

Pros and Cons of Extended Repayment Terms

Extended terms can ease the burden of repayment, but they aren’t without downsides. Here’s a balanced overview:

| Aspect | Pros | Cons |

|---|---|---|

| Payment Flexibility | Lower monthly payments spread over time, reducing immediate financial strain. | Longer terms mean more interest accrues, inflating the total repayment amount. |

| Accessibility | No credit check required on most loans; ideal for those with poor credit. | High risk of debt cycle if payments are missed, leading to rollovers or repossession. |

| Loan Duration | Gives more time to repay without losing your vehicle quickly. | Extended exposure to high fees; some loans have balloon payments at the end. |

| Overall Cost | Potentially avoids short-term default. | Can end up costing far more than the original loan—e.g., a $1,000 loan could balloon to $1,500+ in 60 days. |

What to Look For When Choosing a Car Title Loan with Extended Terms

Not all lenders are created equal. Focus on these factors to find a reputable option and avoid predatory practices. Read the loan agreement carefully for hidden fees like late charges or returned check costs.

- Competitive Interest Rates: Look for APRs below 100% if possible—compare multiple lenders to find the lowest rate.

- Transparent Fees: Ensure all costs (origination, processing, etc.) are clearly listed upfront.

- Flexible Repayment Options: Check for grace periods, early payoff without penalties, or adjustable terms based on your income.

- Lender Reputation: Choose licensed lenders with positive reviews; avoid those with complaints about aggressive repossession.

- State Regulations Compliance: Verify the loan adheres to your state’s caps on terms, amounts, and rates.

- Vehicle Valuation: Get an independent appraisal to ensure you’re not under-loaned based on your car’s worth.

- No Prepayment Penalties: Opt for loans that allow early repayment to save on interest.

Comparison Table of Key Considerations

| Factor | Why It Matters | What to Check For |

|---|---|---|

| Interest Rate (APR) | Determines total cost; high rates can triple your debt. | Rates under 36% if available; calculate total interest over the term. |

| Repayment Term Length | Affects monthly affordability. | 6-48 months; ensure it fits your budget without extending unnecessarily. |

| Fees and Charges | Can add hundreds to your loan. | Itemized list in the contract; watch for hidden rollover fees. |

| Lender Requirements | Ensures you qualify easily. | Proof of income, vehicle title, ID; no excessive paperwork. |

| Customer Support | Helps with issues during repayment. | 24/7 availability, clear communication channels. |

:max_bytes(150000):strip_icc()/car-title-loans-315534_final3-b0f2fb2887e34dbcb867271107c24390.png)

Car Title Loans: Short-Term Cash for Your Title

Alternatives to Car Title Loans

Before committing, consider safer options that don’t risk your vehicle:

- Personal Loans: Unsecured loans from banks or credit unions with lower APRs (around 6-36%) and longer terms.

- Credit Cards: For smaller amounts, use a card with a low-interest promo period.

- Payday Alternatives: Credit union loans or apps like Earnin for short-term advances.

- Budgeting and Side Income: Cut costs or take on extra work to avoid borrowing altogether.

In summary, car title loans with extended repayment terms can provide breathing room in emergencies, but they’re expensive and risky. Always shop around, understand the full terms, and explore alternatives first to protect your finances and your car. If in doubt, consult a financial advisor.